What’s NXT: What happens to travel and tourism?

While parts of business and society are now on a path towards establishing a “new normal”, for much of the tourism industry, crisis is still ongoing. The summer season has provided much‑needed income for several players, but the overall situation is far from stable, and it is unclear how many companies will be able to cope beyond the post-crisis support period. For some, looking forward, next summer feels unthinkably far ahead. In spite of this, it is worth thinking about the future of travel in general. How does it look? And how do we get there?

Edited 200903

As always, when it comes to thinking about the future, it is worth helpful to note pointing out that whilemost things will remain pretty much the same:, change is slow… While most stable trends still exist, some were hit hardaccelerated by the pandemic, with others weakened. I With that in mind, it is easy to exaggerate the significance of what is happening right now, and underestimate what will be important in the long run. But, when several forces act in the same direction, there is still change. Here are three future explorations about what travel could look like in the coming years:

- When it comes to Swedes’ travel choices, even pre-pandemic, short-haul trips gained market share at the expense of exotic destinations. This pattern is driven, among other things, by a shift in focus from the destination to the experience. This is not to say that that Swedish travelers will stop choosing to visit distant destinations, but with fewer departures, an aviation industry hanging by a thread, and “flight shame”, the party will probably be over for a long time to come. While this is good news for climate change, it’s a “Catch-22” moment for the aviation industry: now, very few travelers want to fly as flights are so expensive, inaccessible, and with so few departures to choose fromscarce… because so few are choosing to fly...

- Several years left until recovery for international tourism. Admittedly, we, as humans, have a short memory: from previous disasters, we have learned that as soon as restrictions are lifted and the media stops reporting on the event, we stop worrying about it – and start traveling again. But this time we also have a recession to take into account, as well as more and more companies' travel policies that limit travel for environmental reasons. It will take time for international travel to return to the levels it was operating at before the pandemic, with several international experts estimating a 4-5 year timeline (or longer) for recovery. Travel is based on the fundamental need to rest, to meet to build private and business relationships, and to discover new things: these needs will not disappear – eventually, the industry will recover. Private Leisure travel is recovering faster than business travel, and was, long before COVID-19, the part of travel that contributed to growth. Future growth will mainly take place in markets where travel has not yet fully regained momentumreached its full potential and where travel is strongly linked to GDP development. However, the pandemic has now pushed many countries backwards in development: in a time of increased unemployment, the realization of a traveler’s “dream journey” moves further into the future.

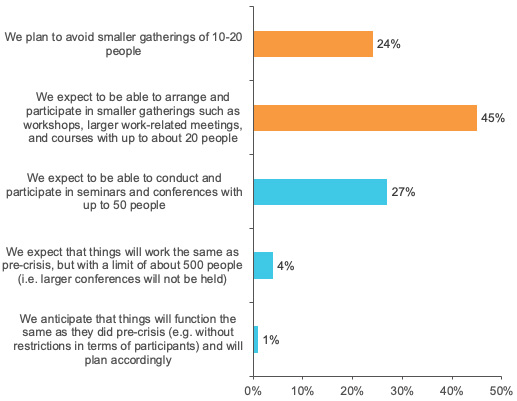

- It is doubtful whether business travel will ever fully recover. An estimate, based on accelerated digitalization and the development in competence that has taken place in the last six months, is that a third of on-site meetings could be cancelledvanish in the long term. The pandemic has been a catalyst for a change that was already underway: we are more skilled than ever at distinguishing between meetings that are most easily managed digitally, versus those that require physical interaction, in addition to weighing invested time against the benefits of physical meetings. When several drivers converge – in this case digitalization, sustainability goals, and convenience – the conditions for actual changes in behavior are positive. Reduced numbers of in-person meetings mean the competition to host them is tough. Those – we guess that the on-site meetings that actually are convened will likely pack an “extra punch” of novelty, excitement, and opportunity for participants, hosts, and vendors alike! In the near future, however, it looks much more dramatic:, almostroughly 70% of the leaders and experts in Kairos Futures Future Barometer state that they plan to avoid all meetings over 20 people in thethis autumn.

Figure 1: Which of the following options best describes your organization’s view on the next 3 months ahead regarding arranging or participating in seminars, workshops, and conferences? Kairos Future Future Barometer, August 2020.

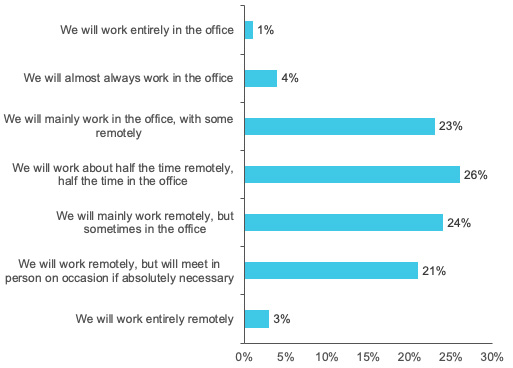

With over close to half of the respondents planning to continue working remotely most of the time, demand for restaurants (especially those located in densely populateddowntown around workplace areas) will dampen. It is possible that instead a certain demand arises near residential areas, when the longing hits for social contact and sushi. Here, too, we can see a permanent change in the long run: perhaps it will become standard to work from home two days a week and be at work the other three. While some have thrived – no more commuting and more time for leisure! – just as many people attest to the fact that prolonged isolation is challenging, and that being creative and innovative comes more easily in the company of others.

Figure 2: In the next three months, to what extent do you think you will work remotely? Select the answer option that best suits your opinion. Kairos Future Future Barometer, August 2020.

All in all, the crisis has impacted industries unevenly. Tourism has always been a low-margin industry that has performed well despite a long period of steady growth. How companies have managed during the pandemic has not so much been about “doing the right thing”, but (more randomly) about the right features: sun terraces, proximity to sun and swimming, and golf courses have provided clear benefits for businesses this summer. It can therefore be said that the crisis strikes unfairly: in simple terms, those who innovated and invested (and are coping with large loans) are struggling, while "fat lazy cats" have fared much better. For example, companies who invested heavily in outbound tourism, and pre-pandemic, targeted lucrative foreign markets, have been hit the hardest. The same logic generally applies to constructed attractions (e.g. amusement parks, concerts, and events) that have been hit hard by travel restrictions, while destinations whose attractions primarily consist of nature experiences have seen record numbers of late. From this, it is difficult to see how the industry will emerge stronger from the crisis.

The travel industry's biggest challenges ahead:

- find new business models, solutions, and collaborations when aspects of traditional business do not return quickly enough.

- retain the best employees through crisis and recession.

- be prepared for future crises: we live in a troubled time where the coronavirus pandemic will not be the last challenge of the coming decade.

Do you want to understand how your business can adapt to the new normal, put your existing strategies through the "wind tunnel test", or develop new concepts or business models? Contact Johanna Danielsson or Erika Charbonnel.