Why Leading Companies Work with Foresight

The world around us is full of clues. They point us to changes that may happen in the coming years and decades and could alter the rules of the game for many. Entire industries can be revolutionized by what a small company does in a garage. Given that these revolutions seem to be accelerating, organizations have developed special tools to stay ahead of the game.

Leaders constantly need to make decisions based not only on certain trends, but also taking into account multiple uncertainties. How do we best deal with this situation? Leading companies work systematically with business intelligence to continuously capture signals that provide guidance to anticipate future directions and identify clear trends. These signals are the foundation of strategic foresight.

What Does the Foresight Research Say?

Do companies that work with foresight even perform better than others? Strategic foresight has grown into a standard practice for many successful companies most of us know today, including Siemens, Pepsi, Deutsche Bank, Boeing, SEB and Apple.

Dr. Rohrbeck – one of the world’s leading researchers on strategic foresight – and his colleague Dr. Ménès Ethingue Kum wanted to quantify the results of foresight strategies. They had one problem though: Almost no academic studies had measured the actual impact of foresight on firm performance. And that is perhaps not very surprising considering that measuring such strategies needs to be done over several years. But to do just that, they had to create a whole new model to make sure they could distinguish the effect of foresight from other factors affecting the performance of companies – a common challenge in research.

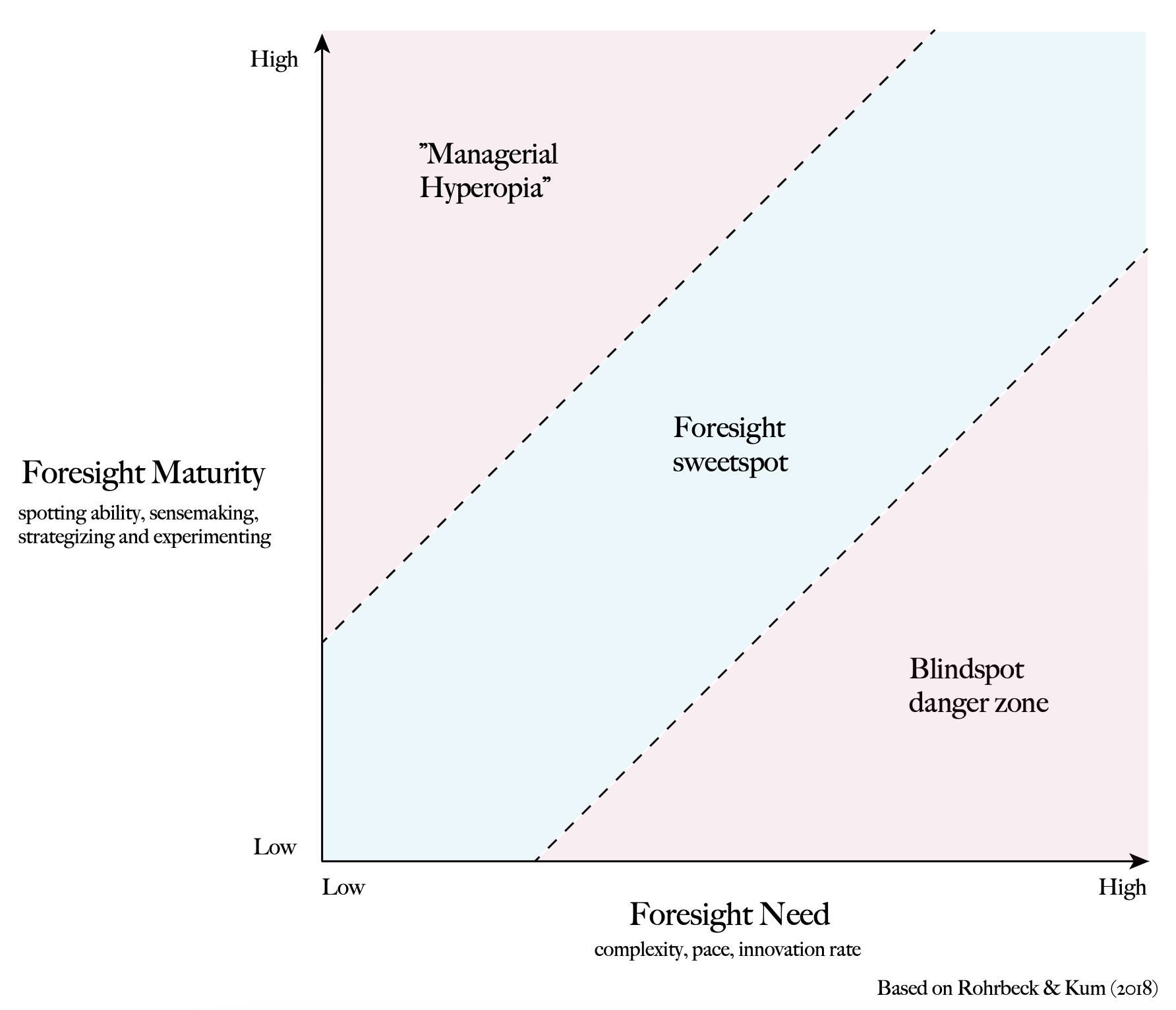

So they decided to distinguish between two aspects: foresight maturity (i.e. how advanced is the current foresight process in the firm) and foresight need (i.e. how much foresight does the firm require). This, they argue, is important to consider because not all organizations operate in the same environment: some are extremely dynamic, fast-paced and with a lot of competitors, others are slower with fewer competitors and less frequent change.

Watch out for Managerial Hyperopia

In short, a firm can have an optimal level of “future preparedness” if its foresight needs are matched by its foresight maturity. Now I imagine your first question to this is: what if an organization’s current foresight practices exceed its needs? Surely, shouldn’t this translate to even better results? Interestingly, the answer seems to be no. Previous research in the field by Day and Schoemaker in 2005 identified a practice in which top management is so concerned with the distant future that they fail to consider the activities closer in time – a rare but real state known as “managerial hyperopia”.

With the concept of “future preparedness” however, Rohrbeck and Kum were able to create a new lens through which they could evaluate performance. They decided to look at two factors: profitability and market capitalization growth. By determining the level of future preparedness of firms in their sample and using data from 2008-2015, they could track how profitability and market capitalization growth developed over this period and investigate the importance of level of future preparedness.

Why Foresight Makes Organizations Better

First and foremost: they concluded that there was strong evidence that foresight has a positive effect on company performance. Those who did have systematic foresight processes (i.e. vigilant firms) had 33% more profitability and a staggering 200% higher market capitalization growth – and remember, this was measured over a seven year period, which is enough time for foresight strategies to kick in. But this is not the only finding.

One of the most relevant aspects about this research is not only that it confirms that foresight is efficient, it also shows that consistency is the key to unlock this efficiency. Even if the number of companies who had very systematic processes was limited, those who did and who stuck with them did on average significantly better than others. Out of all the companies that were considered “vigilant” in the study (i.e. whose foresight maturity matches their needs, in other words those with efficient and systematic processes), 40% became out- performers on the economic metrics and 55% of them remained stable. Only a small 5% fell to the bottom on economic performance.

Compare this to how foresight-deficient firms did. Only 10% moved up to become overperformers (4x less), most remained stable, while 24% had become underperformers over the course of seven years – that’s five times more than vigilant firms.

What about organizations that are not measured by profitability, such as government agencies or non-profits? If we break down the results from the study on a more basic level, profitability and market capitalization growth are really just two indicators of how well an organization is playing by the rules of our current economic paradigm. So, what the results fundamentally mean, is that foresight makes organizations better at navigating the world they are embedded in. Just like a cyclist having to skillfully navigate a street busy with pedestrians, organizations – no matter their objectives, must navigate complex landscapes, watch out for major obstacles and prepare for their future. It is fundamentally a process for all types of organizations and in fact, the foresight process didn’t start in the private sector: it has its roots in military planning for war scenarios. Seeing the value in navigating uncertainty, companies began using foresight as well.

Some Learnings from the Study:

- Systematic use of foresight led to 40% of companies becoming economic overperformers and just 5% becoming underperformers

- No use or wrong use of foresight led to only 10% of company becoming economic overperformers and almost 25% falling to the underperformer category

- Foresight led to an 33% increase in profitability

- Foresight also led to a staggering 200% growth in market capitalization

- Keeping an eye out for early signs is key is building a robust foresight process

- The single most defining factor is having a systematic process

- There are ways of making sure you are using the right amount of foresight

How can you implement foresight?

Working seriously and systematically with business intelligence doesn't have to be difficult, but to have a real impact it requires a slightly higher level of ambition than inviting a lecturer once a year or buying a report. For 30 years, Kairos Future has developed methods and tools based on research and proven practices that make it easy to get started. There is an entire framework and a large toolbox for systematic business intelligence depending on where you are right now. We have also made it easy to build strategies and systematically manage strategic uncertainties based on this material.

If you want to know more, please contact CEO Johanna Danielsson or Olivier Rostang.